Among Europe’s major office markets, the current environment seems particularly challenging for London, given its exposure to co-working and finance, as well as VC funding dependent start-ups. On top of this, still Brexit looms on the horizon. Landlords should be anticipating falling rents and investors should diversify geographically and structurally.

# 1 – COVID-19

While the specific outcome of the COVID-19 related shut-down of economies remains highly uncertain, general risks and consequences for certain property subtypes are more meaningful to call out. For offices, the immediate consequences are highest among co-working and serviced office providers as their revenue streams have mostly come to a halt. In fact, there might be longer-term consequences for two reasons.

a) Dependent on the economic outcome, corporate demand for serviced office solutions will decline for a longer period. As corporate users make up a large share of the coworking user spectrum, consequences would be profound.

b) Companies might be reluctant to commit to space in the future where they do not have control over the general environment and the co-workers in the space.

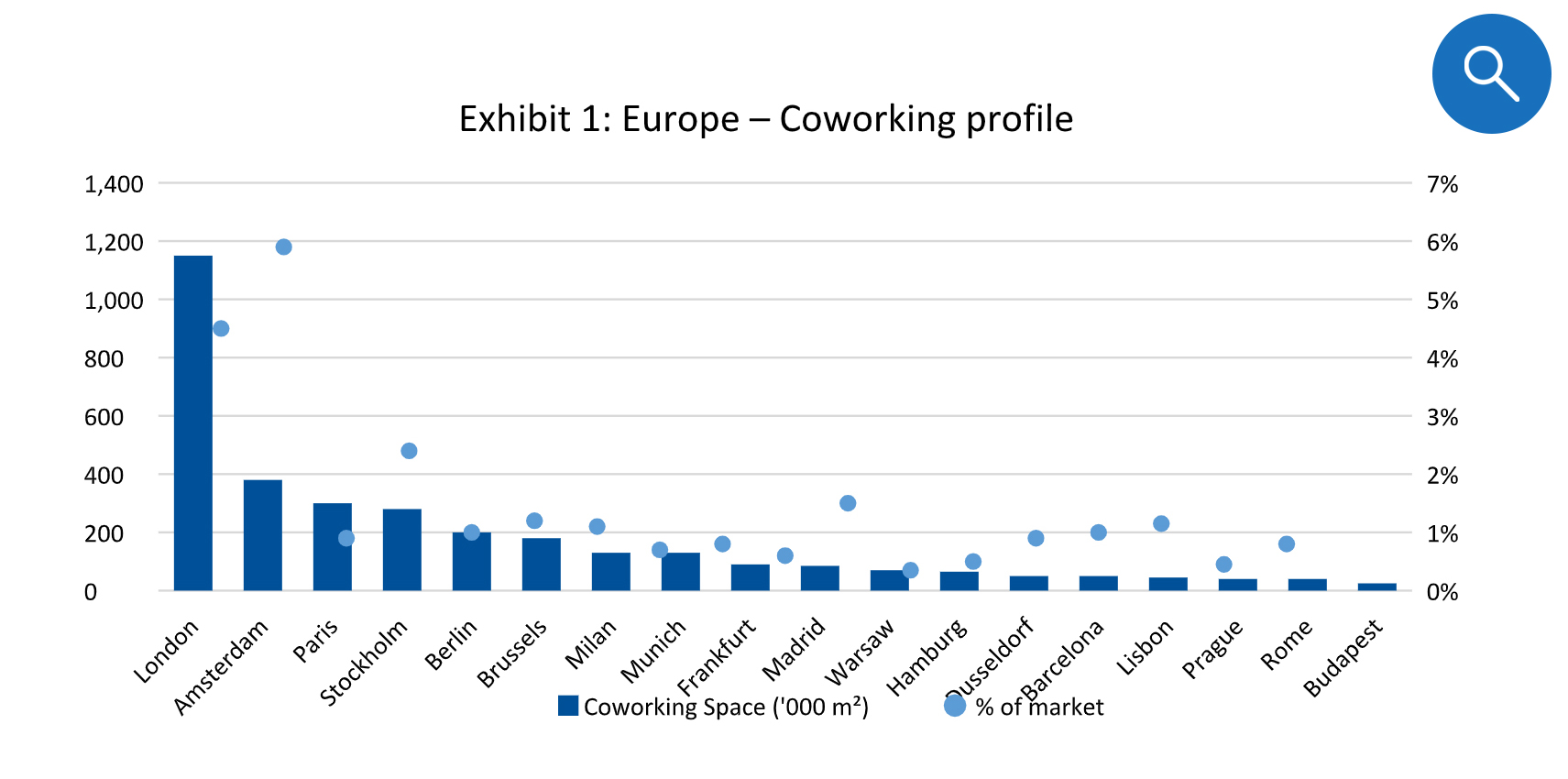

As Exhibit1 shows, there are some markets with a higher exposure to co-working operators. Amsterdam, Stockholm, Warsaw and clearly London face the highest risk here. In fact, following the public sector, Wework is the largest single user of office space in London. Aside Berlin, the German markets, on the other hand, have a relatively low serviced-office penetration.

The other sector at risk is the finance, particularly the banking industry. In an economically difficult environment, credit defaults are likely to rise, which is building risks for the banking sector. In addition, as we will be in an ‘even-lower-for-even-longer’ interest rate environment, banks will face headwinds from this end as well.

Sure, the banking industry is in a much better shape than during the GFC and bankruptcies are less likely, but job redundancies are likely and office space demand from the banking industry will decline1. Markets most at risk from this side are Frankfurt, Luxembourg, Warsaw and, again, London.

Businesses from, for example, the media and entertainment2, from the health and pharma fields, research and development led industries and particularly the public sector will prove more defensive in the short term.

#2 – VC funding retreat

Already before COVID-19 shook the world, the global start-up and venture capital scene has seen some turmoil. Based on some weaker than expected IPOs and the Wework IPO debacle, venture capital de-risked somewhat and became more selective in the start-ups they supported. According to research from CB Insights, global Corporate backed Venture Capital (CVC) significantly declined in both Q3 and Q4 2019.

The situation is amplified in the current environment, as a number of start-ups, which are losing out on revenue are in need of support from (existing) funding partners. In a risk averse environment as today, VC funding for new operations and/or expansions will narrow.

Cities that are mostly affected by this in Europe are London, Berlin, Paris and Amsterdam.

This impact, however, is likely going to be short-lived and we expect a bounce back in activity for both start-up inceptions as well as VC funding to revive quickly when things are normalising.

# 3 – Brexit

It has gotten very quiet around the Brexit Process. But as it stands today, the formal process of the UK leaving will go into the next phase towards the end of this year. As there is still a lot of uncertainty around the process and its consequences, also here, the outcome is difficult to predict. A reduction of space demand remains likely for London and some of the UK’s secondary markets, though.

# Take away

While most European office markets will see reduced demand for office space over the next 12 to 18 months, the individual city profiles dictate the severity of the impact. London is at risk to be hit particularly hard by the demand side. Up until Q4 2019, prime office rents in London have held up remarkably well, given the uncertain circumstances – to some extent supported by coworking operators, which signed leases at a rental premium. Since peaking at the end of 2016, prime rents in both the City of London and the West End have fallen by 7% until Q1 2019 and have even recovered slightly over the course of the year, which compares to a 36% slump in 2008 and 2009 combined3. Given the current circumstances, it is likely that London will face a double digit decline in prime rents over the next 12 months.

For investors, a wide diversification of assets geographically and among tenant types reduces the risk of being hit by current market circumstances. At a city level, exposure to more defensive sectors and/or a highly diverse business structure as well as a strong academic profile help. Example markets that should prove more resilient are Brussels, Copenhagen and Vienna as well as some office markets from the second row, like Cologne, Nuremberg or The Hague.

1 JPMorgan, for example, announced to set aside USD 6.8 bn to cover potential losses on loans to consumers and businesses (WSJ, 14.04.2020) | 2 Source: PMA. N.B: The metrics is prime headline rent, excluding incentives. Adding incentives, rental declines in both cycles have been more pronounced | 3 Particularly those specialized in gaming and streaming services

DISCLAIMER

This document has been prepared for general information purposes only. It does not constitute an offer or invitation to sell or issue, or to purchase or subscribe any shares in funds, securities or financial instruments, or any other shareholdings in or distributed by CORESTATE Capital Holding S.A. or any other company of the CORESTATE Capital Group (hereafter collectively referred to as the “Company”). No part of this document nor the fact of its distribution be or form part of or be relied on in connection with any contract or investment decision relating thereto, nor does it constitute a recommendation regarding the securities or the shares in funds or other financial instruments of the Company or of another entity. Therefore, this cannot be deemed as financial services, investment advisory services, an offer for the acquisition of a financial instrument or general investment advice, legal or tax advice.

The data and information contained herein has been obtained from various sources is believed to be reliable and accurate. All data and information derive from sources which the Company believes to be reliable. Furthermore, the Company has used its best endeavors to ensure that the presented facts and opinions are adequate and correct. Forward-looking statements and statements are based on current estimates, expectations and forecasts of the Company regarding market and industry developments at the time of preparation.

Nevertheless, no reliance may be placed for any purposes on the information contained in this document or on its completeness, accuracy or fairness. Neither the Company nor any of its directors, officers or employees or any other person makes any warranty or gives any guarantee, neither express nor implied, as to the accuracy or completeness of the information contained in this document, and accepts no liability for loss or damage of any kind in connection with this document, unless caused by gross negligence or intent of the Company and unless standing in a causal connection to the potential damage. The information is subject to change at any time (even without notification to the recipients). This document is an advertisement and not a financial analysis or a prospectus. The information and opinions expressed in this document are provided as of the date of this document. Certain statements, beliefs and opinions in this document, are forward-looking, which reflect the Company’s or, as appropriate, the Company’s directors’ current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document. No statement in this presentation is intended to be nor may it be construed to be a profit forecast. By attending the presentation to which this document relates or by accepting a copy of this document you agree to be bound by the foregoing limitations and, in particular that you have read and agreed to comply with the contents of this notice.

This presentation has been compiled by Corestate Capital Investors (Europe) GmbH, a company of the CORESTATE Capital Group, 19.05.2020.