Corestate Capital Group – Cashflow Forecast as of 30 Sept 2023

Reporting Obligation for “Reinstate Notes 2022”, “Reinstate Notes 2023” and “New Super Senior Notes”

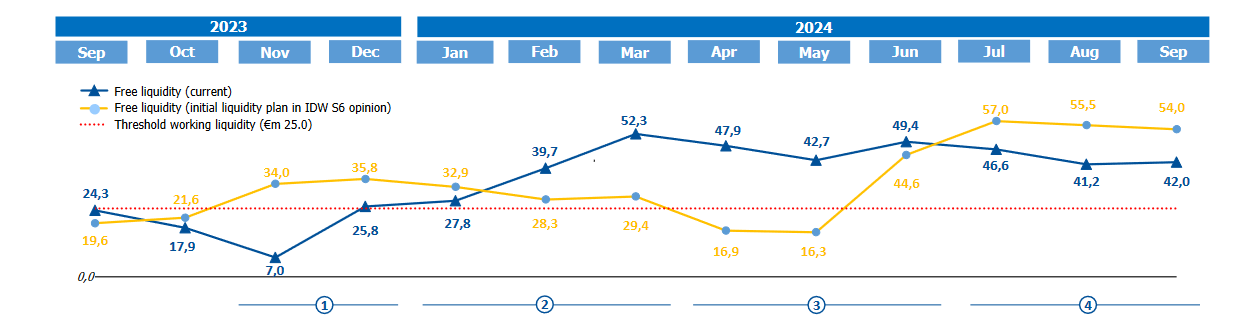

Liquidity FC shows timing shifts in cash events, CC’s repayment plans are overall on track

Key assumptions

- Liquidity plan has been derived by management and is based on a direct liquidity forecast from the treasury management system for each legal entity/ subgroup prepared by CORESTATE treasury / the 2024 liquidity events are derived from the draft 2024 budget which is still being finalized

- Starting balance (€m 24.3) represents freely transferable liquidity as per 30 September 2023; HL and Corestate Bank integrated in intragroup liquidity management which reduced “trapped/restricted” cash to €m 16.6 end of September 2023 and €m 11.2 end of October 2023 respectively

- Main assumptions regarding interest and debt repayment: interest payment for 12/2023 will be a PIK payment / interest payments for new super senior notes in 06/2024 and 12/2024 expected / no interest payments in 2023 or 2024 on both reinstated notes in line with restructuring agreement / debt repayment subject to asset disposal realization

Key Developments (main cash events)

- Main one-time cash events relate to divestment of several co-investments at Corestate level (appr. €m 3.5) and to M&A activities (appr. €m 9.0)

- Main one-time cash events relate to a planned placement of remaining co-investment shares at Hannover Leasing level (appr. €m 10.0), the sale of several co-investments at Corestate level (appr. €m 7.0m) and partial repayments of different mezzanine loans (appr. €m 3.5); additional funds could result from the sale of other financial instruments (appr. €m 15.0)

- Main one-time cash events relate to partial repayments of different mezzanine (appr. €m 12.0)

- No major cash events currently planned for Q3 2024

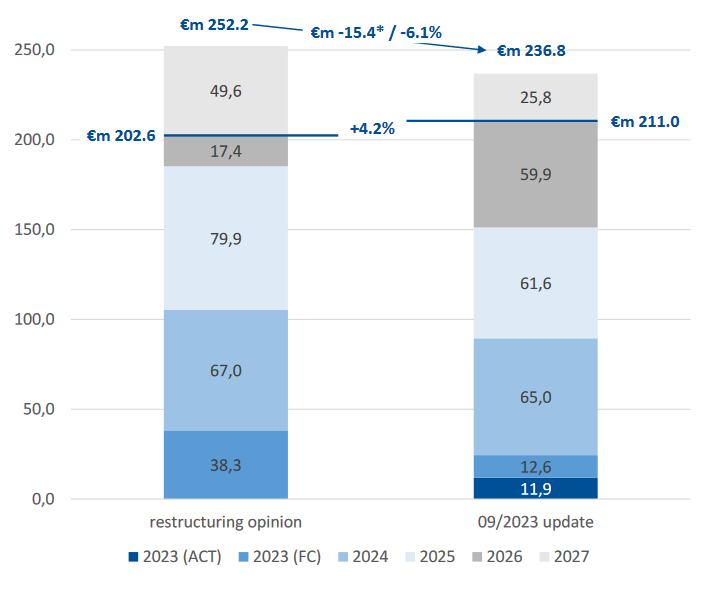

Available asset run-off until 2026 remains almost unchanged by making use of portfolio measures

Comparison of initial & current asset disposal plans

The restructuring opinion foresaw asset disposals in the total amount of €m 202.6 until 2026; based on the September 2023 update, the asset disposal capacity increases slightly to €m 211.0 due to time shifts.

- 2023: the initially planned €38.3m are currently considered to be lower at €m 24.5, incl. the non-planned sale of CRM (€m 9.1); at the publication of this document €m 11.9 have been realized primarily from the sale of several Spanish assets

- 2024: the initially planned €m 67.0 are currently expected to remain relatively stable at €m 65.0 primarily due to the earlier sale of some financial instruments (€m 15.0 in 2024 instead of €m 23.0 in 2027) which off-set project delays to 2026 and 2027

- 2025: the initially planned €m 79.9m are currently expected to decrease to €m 61.6 as several projects are expected to be disposed earlier (e.g. €m 12.0 repayment of mezz loans in 2024 instead of 2025)

- 2026: the initially planned €m 17.4 are expected to notably increase to €m 59.5 due to several disposals that are expected to be delayed to 2026 The assets with limited liquidity after 2026 (initially appr. €m 50) are reduced primarily by the time shift of the sale of some financial instruments (see also 2024)+

* The total asset run-off in the amount of €m 252.2 was reduced by €m 29.4 until 30 September 2023 primarily due to realized sales below initial value (€m -4.5) and reduced sales expectations (€m -24.9). This was off-set by portfolio measures comprising the sale of CRM (€m 12 in total; appr. €m 9.0 in 2023 and appr. €m 1.0 in 2024-2026) and URE (appr. €m 2.0 in January 2024).

Disclaimer

This presentation contains forward-looking statements that are subject to various risks and uncertainties. Such statements are based on a number of assumptions, estimates, projections or plans that are inherently subject to significant risks, as well as uncertainties and contingencies that are subject to change. Actual results can differ materially from those anticipated in the forward-looking statements of CORESTATE Capital Holding S.A. (the “Company”) as a result of a variety of factors, many of which are beyond the control of the Company, including those set forth from time to time in the Company’s press releases and reports and those set forth from time to time in the Company’s analyst and investor calls and discussions. The company does not assume any obligation to update the forward-looking statements contained in this presentation. This presentation does not constitute an offer to sell or a solicitation or offer to buy any securities of the Company, and no part of this presentation shall form the basis of or may be relied upon in connection with any offer or commitment whatsoever. This presentation is being presented solely for information purposes and is subject to change without notice.