In continental Europe, private real estate debt is still an emerging market and remains far behind the UK, and particularly Asia and the US when it comes to the market share in real estate financing. This keeps changing though – and the experience made over the last 18 to 24 months has further strengthened its attractiveness for institutional investors. Because contrary to the real estate equity market, real estate finance did not see an investible supply bottleneck. Instead finance opportunities were plenty, securing investors’ opportunities to allocate capital to ‘put the money to work’ and avoid the storm of uncertainty. Just, don’t get struck by a foul-credit-lightning – the quality of the underlying asset remains key in today’s environment.

As COVID-19 hit Europe and the US in early 2020, global uncertainty spiked, public life was locked-down, and markets have dried. Since then, a couple of times there were hopes and optimism that the worst is over and the situation normalises. However, the pandemic has proven dramatically unpredictable and at the time of writing this, Germany is in the middle of its fourth and potentially most severe wave so far.

This created an environment during large parts of 2020 where both investors and property owners remained at the side lines, waiting for the fog of uncertainty to lift. Only few properties were offered to the market, which led to a shortage of investable supply, particularly in the core spectrum. For low-risk assets, however, investor demand was strong, which lead to a severe imbalance of supply and demand causing prices to rise.

At the same time, banks quickly became highly risk averse concerning any financing that was non-core. This has strengthened the role of alternative lenders like private real estate debt funds, who stepped in and filled the financing gap to some extent.

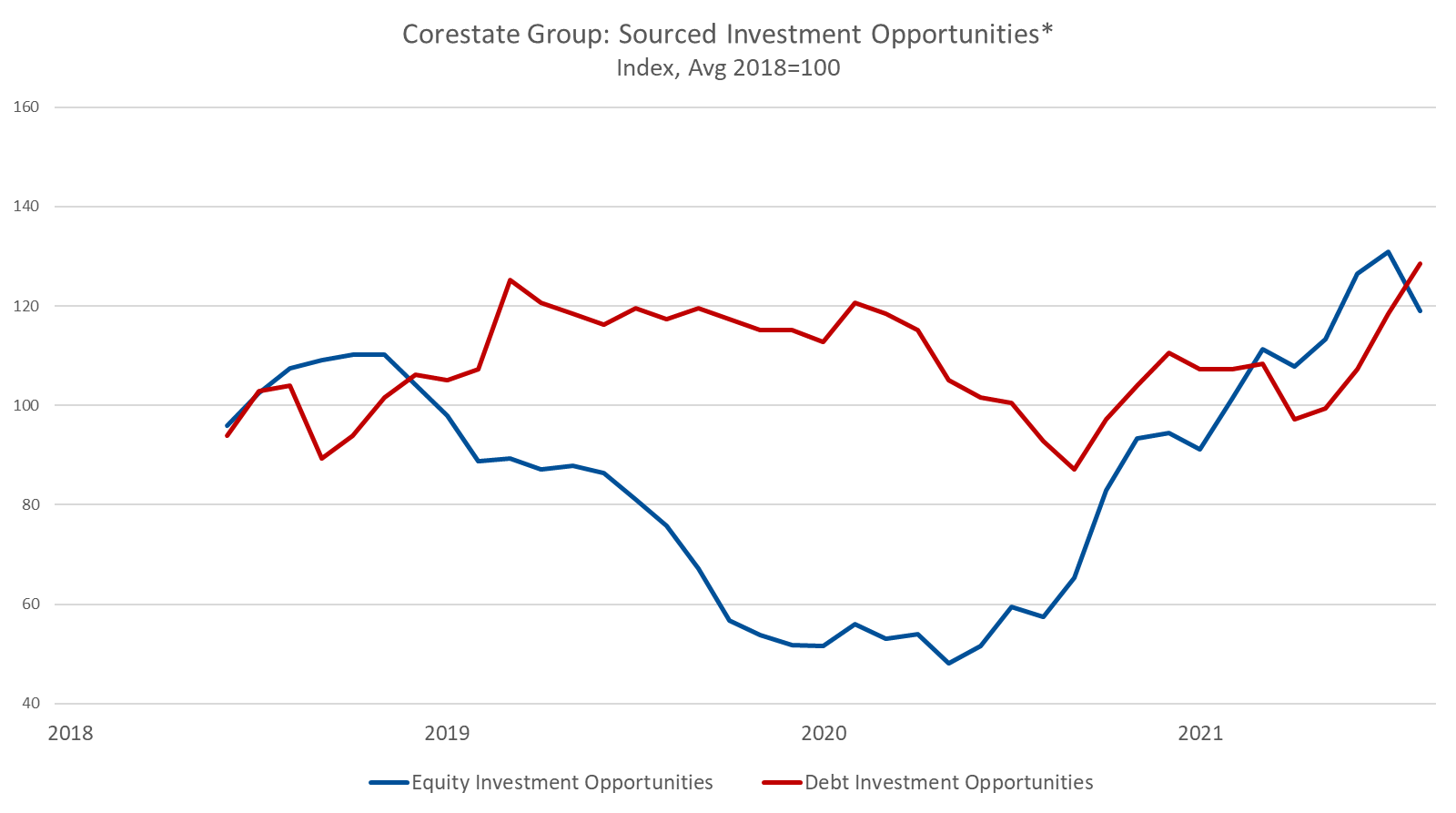

In contrast to real estate equity, at the debt side of things, there was no shortage of investment opportunities. As the chart below indicates, investment opportunities were plenty and investors were able to allocate money and generate income.

The data is based on CORESTATE Groups sourced investment opportunities for both equity and real estate debt. As it is based on internal analyses, it does not necessarily replicate the entire market’s activity and has to be seen as a proxy. Still, the message is clear, the private debt market tends to be more resilient in times of crises when it comes to remaining liquid and investable.

In a challenging environment, however, it is key to assess the risk of the underlying property properly and to understand where the market is headed. In depth micro and macro research and an extensive real estate asset management expertise can help doing so.

DISCLAIMER

This document has been prepared for general information purposes only. It does not constitute an offer or invitation to sell or issue, or to purchase or subscribe any shares in funds, securities or financial instruments, or any other shareholdings in or distributed by CORESTATE Capital Holding S.A. or any other company of the CORESTATE Capital Group (hereafter collectively referred to as the “Company”). No part of this document nor the fact of its distribution be or form part of or be relied on in connection with any contract or investment decision relating thereto, nor does it constitute a recommendation regarding the securities or the shares in funds or other financial instruments of the Company or of another entity. Therefore, this cannot be deemed as financial services, investment advisory services, an offer for the acquisition of a financial instrument or general investment advice, legal or tax advice.

The data and information contained herein has been obtained from various sources is believed to be reliable and accurate. All data and information derive from sources which the Company believes to be reliable. Furthermore, the Company has used its best endeavors to ensure that the presented facts and opinions are adequate and correct. Forward-looking statements and statements are based on current estimates, expectations and forecasts of the Company regarding market and industry developments at the time of preparation.

Nevertheless, no reliance may be placed for any purposes on the information contained in this document or on its completeness, accuracy or fairness. Neither the Company nor any of its directors, officers or employees or any other person makes any warranty or gives any guarantee, neither express nor implied, as to the accuracy or completeness of the information contained in this document, and accepts no liability for loss or damage of any kind in connection with this document, unless caused by gross negligence or intent of the Company and unless standing in a causal connection to the potential damage. The information is subject to change at any time (even without notification to the recipients). This document is an advertisement and not a financial analysis or a prospectus. The information and opinions expressed in this document are provided as of the date of this document. Certain statements, beliefs and opinions in this document, are forward-looking, which reflect the Company’s or, as appropriate, the Company’s directors’ current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document. No statement in this presentation is intended to be nor may it be construed to be a profit forecast. By attending the presentation to which this document relates or by accepting a copy of this document you agree to be bound by the foregoing limitations and, in particular that you have read and agreed to comply with the contents of this notice.

This presentation has been compiled by Corestate Capital Investors (Europe) GmbH, a company of the CORESTATE Capital Group, 02.07.2021.