The Corestate Capital Group (Corestate) published its results for the 1st quarter of 2022 today. According to the figures, consolidated aggregated revenues and gains amounted to € 37.6m (previous year: € 37.3m)

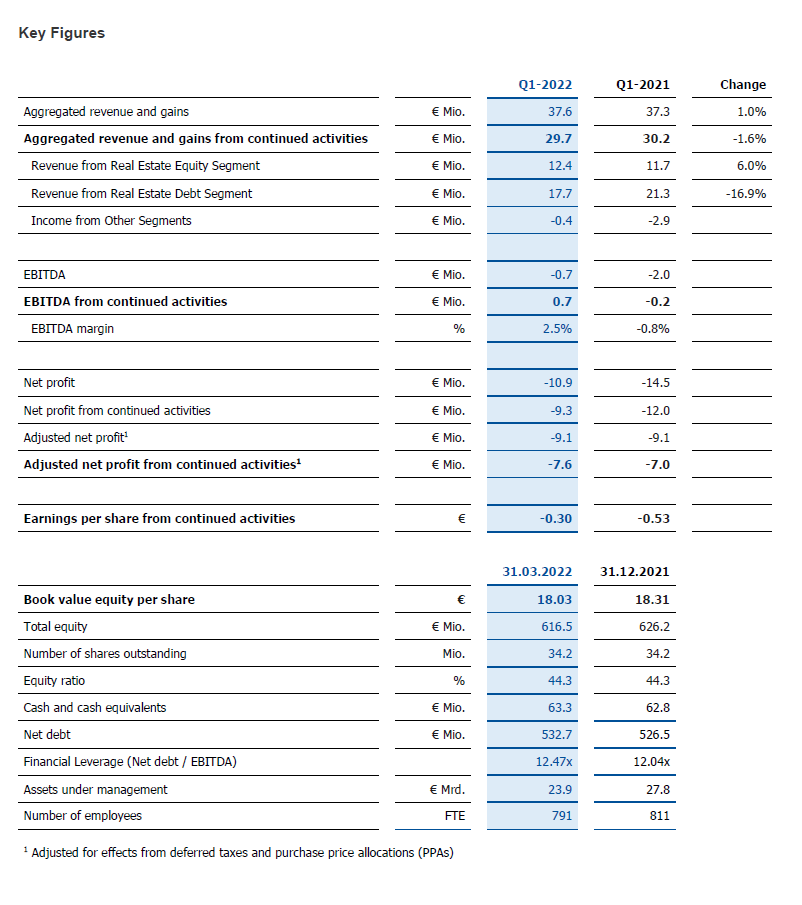

Frankfurt, 10 May 2022 – The Corestate Capital Group (Corestate) published its results for the 1st quarter of 2022 today. According to the figures, consolidated aggregated revenues and gains amounted to € 37.6m (previous year: € 37.3m). The aggregated revenues and gains from continued activities stood at € 29.7m, compared to € 30.2m in the same quarter of the previous year. EBITDA from continued business activities improved from minus € 0.2m in 2021 to € 0.7m. Net profit from continued business activities adjusted for one-off effects amounted to minus € 7.6m (previous year: minus € 7.0m). Real estate assets under management within Corestate’s core business amounted to approximately € 18.4bn as at the end of the 1st quarter 2022.

Income in the Real Estate Equity segment proved to be largely unchanged compared to the same quarter of the previous year. While debt business recorded higher income from performance fees in the first three months of 2022, the segment as a whole saw a slight decline. Overall, the company’s operating results are slightly below the planned targets, despite declining negative impacts due to the coronavirus pandemic.

The sale of the property management activities, initiated within the scope of the concentration on the core real estate business, is progressing according to plan. The purchase agreement for CAPERA (book value € 2.6m) was signed at the end of April. The transaction involves more than 270 employees, € 18m in aggregated revenues and gains in 2021 and approximately € 2.5bn in assets under management. The sale is expected to close in the 2nd quarter 2022, resulting in a cash inflow of €14.5m. The marketing approach for the shopping centre in Giessen will be also relaunched after completion of the modernization work with a clear focus on optimising the sales price. The refurbishment measures expected to be largely completed in the 3rd quarter, with the resulting increase in the overall architectural appeal already leading to higher tenant occupancy.

Debt reduction and refinancing of the Group remain core issues on the financial level. At the end of the 1st quarter, Group net financial debt amounted to € 532.7m (2021: € 526.5m), while cash and cash equivalents stood at € 63.3m (2021: € 62.8m). In the light of the measures initiated to generate additional liquidity Management is currently analyzing appropriate options in parallel to refinance the bonds maturing in November 2022 and April 2023. For this purpose, Corestate has brought a financial advisor on board, who, if necessary, will prepare possible alternative scenarios together with the company. The Management Board will continue to prioritize the steps already taken to optimize the capital structure and free up liquidity.

The significant rise in macroeconomic risks generated since the outbreak of war in Ukraine and the ongoing disruptions to global supply chains are now also affecting the real estate sector. The dynamic interest rate and inflation structure is already leading to a decline in transaction business and greater restraint among clients. In addition, there are also increased uncertainties due to the as yet unresolved question of the company’s refinancing with potentially adverse implications for new business in the current year. Given the apparent decrease in income as a result, particularly in association with acquisition and performance-related fees in the core markets and products, the company no longer considers it likely that it will achieve the originally planned and published targets for the financial year.

However, due to the high degree of uncertainty, it is currently not possible to provide a reliable figure for a precise deviation. The Management Board is therefore withdrawing the forecast for fiscal 2022 and the corresponding dividend statement until further notice.

About CORESTATE Capital Holding S.A. (CORESTATE)

CORESTATE is an investment manager and co-investor with around € 24 billion in assets under management. The company sees itself as a manager for the entire length of the real estate value chain. Thanks to its fully integrated real estate platform, it is able to offer investors a wide range of services, especially the opportunity to invest in large-scale societal trends such as urbanisation, demographic shifts or sustainability – trends that will continue to have a decisive influence on the living and working environment in the long term. The consistent focus on asset classes that will be successful in the long run constitutes a central cornerstone of the company strategy. At CORESTATE, all concepts are supported with ESG expertise that is unique to the industry. With some 850 experts, CORESTATE offers clients and investors a full range of services and consultation from a single source, from project financing and real estate management to sales. CORESTATE is listed on the Frankfurt Stock Exchange and operates as a respected business partner for institutional and semi-institutional investors as well as high-net-worth private investors in 11 countries across Europe, with offices in Frankfurt, Vienna, Zurich, Paris, Madrid and London. Please visit www.corestate-capital.com for further information.

Forward-looking statements

This press release may contain certain forward-looking statements based on current assumptions and forecasts made by our management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial position, development or performance of the Company and the estimates given here. These factors include those described in published reports. These reports are available on our website www.corestate-capital.com. The Company assumes no obligation whatsoever to update these forward-looking statements or to conform them to future events or developments. No inappropriate significance should be attached to forward-looking statements, which apply only to the date of this communication.