The Corestate Capital Group (Corestate) has published its results for the first nine months of 2022. In its core business, real estate equity and real estate debt, assets under management amounted to € 17.3bn as at 30 September 2022 (2021: € 20.0bn).

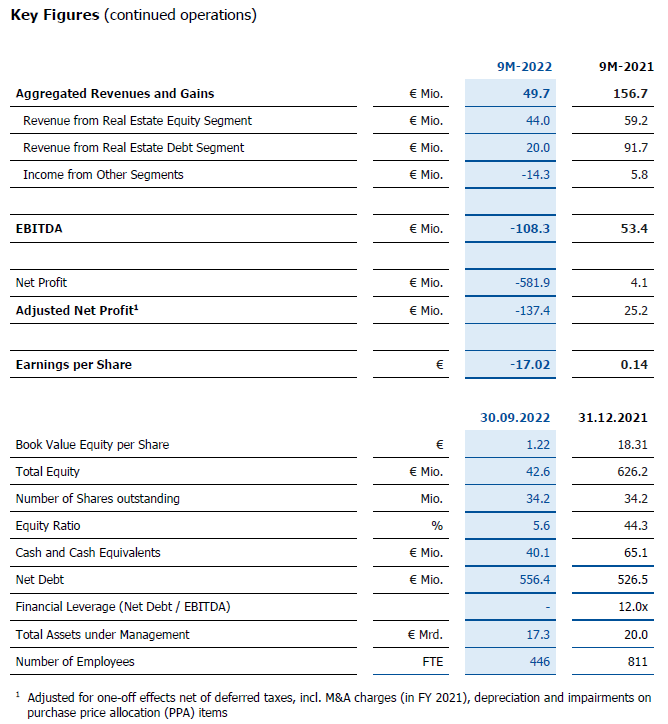

Luxembourg, 15 November 2022 – The Corestate Capital Group (Corestate) has published its results for the first nine months of 2022. In its core business, real estate equity and real estate debt, assets under management amounted to € 17.3bn as at 30 September 2022 (2021: € 20.0bn). On the income side, aggregated revenues and gains from continuing operations in the reporting period 2022 were down and stood at € 49.7m (previous year: € 156.7m). The noticeable decline in macroeconomic conditions in combination with interest rate and inflation trends has led to a substantial slump in transaction volume in the real estate sector since early this year. As a result, the Group and especially the Real Estate Debt segment has seen a sharp fall in revenue from structuring and financial advisory services. In addition, the restructuring process of the Stratos funds has meant the end of income from performance fees, pushing aggregated revenues and gains in the Debt segment down to a low € 20.0m (previous year: € 91.7m). Revenue in the Real Estate Equity segment stood at € 44.0m (previous year: € 59.2m), primarily on account of the near complete loss of transaction-related income compared to the previous year.

In the first nine months of 2022, consolidated EBITDA from continuing operations amounted to € -108.3m, compared to € 53.4m in the previous year. This development was primarily due to one-off expenses for risk provisioning and impairments related to bridge loans, performance fees and real estate projects. At the end of September 2022, the company has written off the entire goodwill of HFS as an expense on account of the perspective business development and the associated earnings expectations going forward. In consideration of all expense items, including impairments and write-downs on goodwill and intangible assets, the Group recorded net income from continuing operations of € -581.9m (previous year: € 4.1m). Net profit from continuing operations, adjusted for one-off effects from write-downs and deferred taxes, currently stands at € -137.4m (previous year: € 25.2m).

In the third quarter, the Management Board systematically continued the measures initiated at the beginning of the year to increase efficiency and reduce costs as well as adjust existing capacities to current business volumes. The declared aim remains achieving a structural transformation of the Group into an efficient and effective investment house with the existing focus on real estate equity and debt business by the end of the year. To this end, operating units will continue to be bundled, duplicate functions and overheads reduced, individual locations closed, and all non-personnel costs and other expenses reviewed.

Beyond the operational and market challenges, securing the Group’s liquidity remains a top priority. At the end of September 2022, the Group’s net financial debt amounted to € 556.4m (2021: € 526.5m), while the Group’s consolidated cash and cash equivalents stood at € 40.1m (2021: € 65.1m). With regard to the two maturing bonds – a € 188m convertible bond (November 2022) and a € 300m bond (April 2023) – the Management Board continued the talks with a group of major bondholders and their advisors as well as several potential equity investors in the third quarter in order to explore a viable alternative refinancing solution. A vote on the necessary amendments to the articles of association is scheduled to be held at an extraordinary general meeting on 22 November 2022. The company has also invited the holders of its two bonds to creditor meetings to be held on 28 November 2022 to decide on the restructuring concepts that have been submitted. The corresponding resolution proposals and documents are available on the company’s website at https://corestate-capital.com/en/nhm/.

The complete interim statement is available here: https://corestate-capital.com/en/aktionaere/publications/

About CORESTATE Capital Holding S.A. (CORESTATE)

CORESTATE is an investment manager and co-investor with around € 19 billion in assets under management in the core business. The company sees itself as a manager for the entire length of the real estate value chain. Thanks to its fully integrated real estate platform, it is able to offer investors a wide range of services, especially the opportunity to invest in large-scale societal trends such as urbanisation, demographic shifts or sustainability – trends that will continue to have a decisive influence on the living and working environment in the long term. The consistent focus on asset classes that will be successful in the long run constitutes a central cornerstone of the company strategy. At CORESTATE, all concepts are supported with ESG expertise that is unique to the industry. With more than 500 experts, CORESTATE offers clients and investors a full range of services and consultation from a single source, from project financing and real estate management to sales. CORESTATE is listed on the Frankfurt Stock Exchange and operates as a respected business partner for institutional and semi-institutional investors as well as high-net-worth private investors in 11 countries across Europe, with offices in Frankfurt, Vienna, Zurich, Paris, Madrid and London. Please visit www.corestate-capital.com for further information.

Forward-looking statements

This press release may contain certain forward-looking statements based on current assumptions and forecasts made by our management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial position, development or performance of the Company and the estimates given here. These factors include those described in published reports. These reports are available on our website www.corestate-capital.com. The Company assumes no obligation whatsoever to update these forward-looking statements or to conform them to future events or developments. No inappropriate significance should be attached to forward-looking statements, which apply only to the date of this communication.