Luxembourg, 4 May 2023 – The Management Board of Corestate Capital Holding S.A. (“Corestate”) has approved the implementation of an alternative restructuring concept (“Alternative Concept”) with broad support from a group of major noteholders, other investors and significant shareholders. This will allow a sustainable debt reduction and recapitalization of the Group to be implemented in the short term, also independently of the availability of audited financial statements for the financial year 2022. Despite intensive efforts on the part of Company, the appointment of an auditor continues to be delayed.

The Alternative Concept includes adjustments to corporate governance, as part of which Dr. Nedim Cen moves today from his position as Chairman of the Supervisory Board to the Management Board as CEO. Considering the progress made in the restructuring, Stephan Goetschel will step down from the Management Board as Chief Restructuring Officer (CRO) and will continue to support the Company as an advisor. At the Supervisory Board, Dr. Sven-Marian Berneburg will take over as Chairman, and Dr. Carlos E. Mack has been appointed today by co-optation as a new Member of the Supervisory Board.

As part of the Alternative Concept, an increase in bridge financing from €25m to €35m was also agreed with existing and new capital providers. This will be made available by mid-May 2023. This serves to secure and further develop the Group’s general liquidity and provides additional flexibility for the value-optimizing disposal of balance sheet assets. At the same time, this creates a key building block for fulfilling one of the Conditions Precedent of the noteholders’ meeting on 14 April 2023, at which the maturity of the two outstanding bonds was initially resolved by 31 July 2023. Subsequently, the Alternative Concept, which is to be adopted at a further noteholders’ meeting in June 2023, envisages a reduction in the nominal amounts of the bonds from a total of around € 500m to around € 100m and an extension of the maturities to 2026. The bridge financing is to be replaced in the long term by senior notes (“new super senior notes”) in the amount of EUR 37 million maturing in 2026.

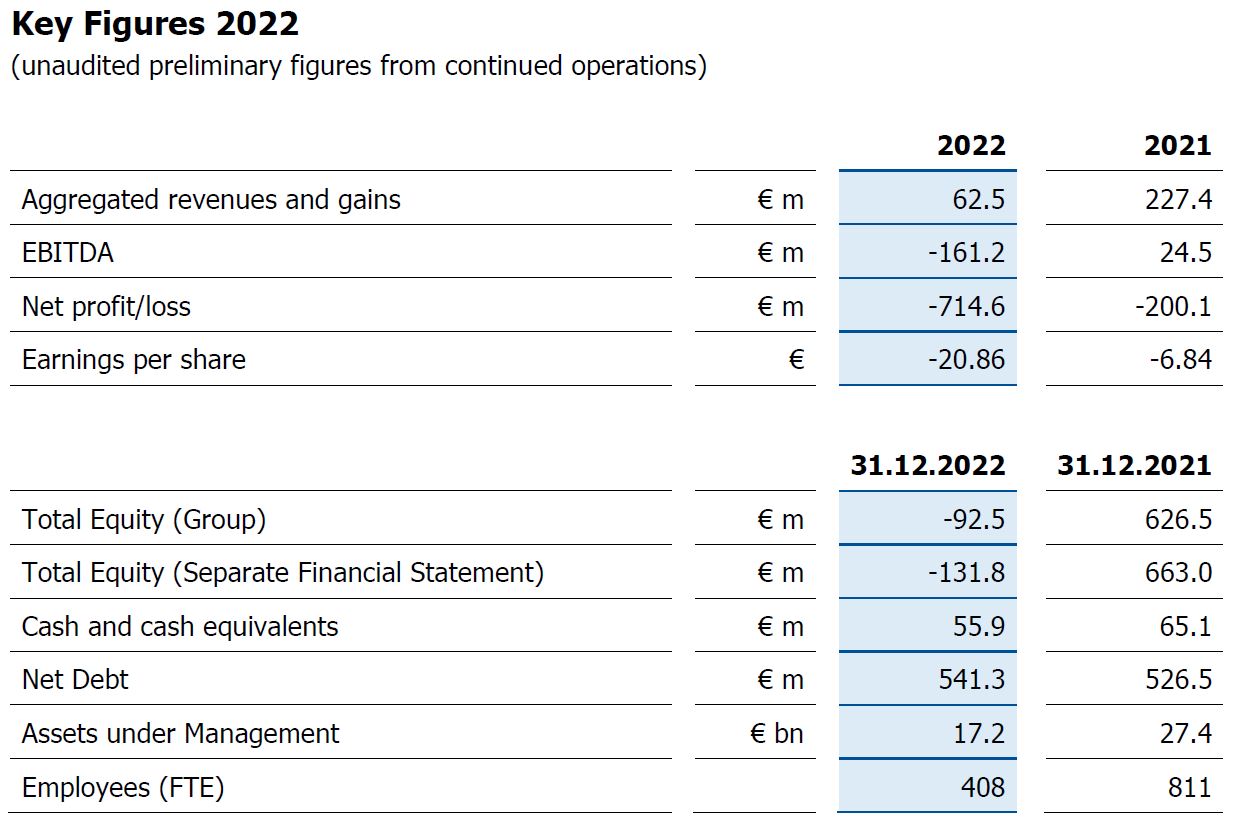

Regarding the business figures, the burdens on earnings due to a decline in revenues and non-recurring effects, which were identified while reporting during the year 2022, continued in the fourth quarter. Accordingly, on an unaudited and preliminary basis, the Group reports aggregated revenues of around € 63m, EBITDA of around € -161m and a net loss of around € -715m for the full year 2022. This will result in negative equity at the end of 2022 at the level of the separate financial statements of around € -132m. Against this background, the Company’s capital is to be restructured as part of the Alternative Concept by means of a capital cut followed by a capital increase (coup d’accordéon) at an Extraordinary General Meeting in June 2023. In combination with the reduction of the nominal amount from the two bonds by around € 400m, this enables the company to achieve a positive equity base in the low to mid three-digit million-euro range in the future. As a result, this consistent recapitalization will put the balance sheet structure and the Company’s leverage back on a stable basis.

Irrespective of this, the Management Board will also pass a resolution at the next General Meeting on the going concern of the Company in view of the negative equity in accordance with corresponding Luxembourg law. In addition to the approval at the respective meetings, the implementation of the Alternative Concept is also subject to the submission of an IDW S6 restructuring report, which is already available in draft form.

About Corestate Capital Holding S.A. (Corestate)

Corestate is an investment manager and co-investor with € 17.2 billion in assets under management in the core business. The company sees itself as a manager for the entire length of the real estate value chain. Thanks to its fully integrated real estate platform, it is able to offer investors a wide range of services, especially the opportunity to invest in large-scale societal trends such as urbanization, demographic shifts or sustainability – trends that will continue to have a decisive influence on the living and working environment in the long term. The consistent focus on asset classes that will be successful in the long run constitutes a central cornerstone of the company strategy. At Corestate, all concepts are supported with ESG expertise that is unique to the industry. With more than 400 experts, Corestate offers clients and investors a full range of services and consultation from a single source, from project financing and real estate management to sales. Corestate is listed on the Frankfurt Stock Exchange and operates as a respected business partner for institutional and semi-institutional investors as well as high-net-worth private investors in 11 countries across Europe, with offices in Luxembourg, Frankfurt, Munich, Zurich, Paris and Madrid. Please visit www.corestate-capital.com for further information.

Forward-looking statement

This press release may contain certain forward-looking statements based on current assumptions and forecasts made by our management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial position, development or performance of the Company and the estimates given here. These factors include those described in published reports. These reports are available on our website www.corestate-capital.com. The Company assumes no obligation whatsoever to update these forward-looking statements or to conform them to future events or developments. No inappropriate significance should be attached to forward-looking statements, which apply only to the date of this communication.