Doing some end-of-the-year housekeeping on my computer, I stumbled across a 14-month old ‘almost finished’ blog post. It discusses the challenges that offices are facing, making suggestions to landlords and investors of how to protect against any such headwinds.

As the content is still extremely relevant and timely, I decided to use it as the last piece of this year, even though some of it seems a bit out of place (a summer vacation reference…). Anyway, happy reading!

A few months back, I was discussing a set of slides with my boss. Me, occupying my baby’s nursery (since writing this we got our second baby!1), which I had annexed during the great lockdown, he, sitting in his car at a pine-lined beach in France during his well-deserved vacation. Was it any worse than sitting in one physical space? Not very much. And thinking purely professionally, for that occasion, not at all. So, why return to the office?

Acknowledging all discussions, doomsaying and denial of the last few months (and years), I think it is fair to say that the future of the office is neither black nor white. And, while offices clearly have a future, the lives of asset managers and landlords have become more difficult: the industry needs to find ways to attract office workers – or entire companies in fact – to their assets. To do so, one needs to make them want to be in the office. If you don’t, your income is at risk.

The super-mobile society

For a number of years, there have been protectionist tendencies globally, the most prominent claim of this being ‘America First’2. As COVID-19 hit, such tendencies strengthened initially, as international travel was and still is highly restricted. This led to claims that globalisation could halt or reverse due to the highly restricted mobility. But was it though?

Only partly, because technology helped to overcome physical distancing and travel restrictions. We are in the position to work on international projects from remote locations – as long as the digital infrastructure is of sufficient quality. The pandemic has shown impressively: The location in the physical world has become much less relevant.

The continuous rise of the super-mobile society, which embraces locational independence and supra-national exchange, will continue to facilitate a secular shift of work ethics and practices. And, while there is still a lot of technical potential in the virtual world3, typical office-bound professions have seen a massive boost in locational independence over the last twelve (twenty-four) months.

Very generally, for quite some time, we have seen a transition of power from producers to consumers. Think streaming platforms like Netflix, which allow the consumer to build the programme, taking it away from classic broadcasters. Similarly, the super-mobile society, which includes companies, chooses the place of work. And, as this is a matter of choice – there need to be reasons to go to the office.

A risk to traditional office space demand

Given the high degree of uncertainty stemming from the pandemic itself and the vastly increased office worker mobility, market opinions of the impact on the office sector vary to a great deal (this has not changed over the last 14 months). There are cautiously optimistic views, claiming that the impact on the market will be minimal and any decline in workforce appearance in the office will be offset by the need for larger and more conference rooms, for example. On the other hand, Capital Economics, has in an early study 4 calculated the potential impact of the effect of mobile working for Europe’s largest office markets.

Capital economics expects the office vacancy rates in most European markets to rise constantly over the next five to ten years, varying by market. While the impact differs strongly from market to market, in some instances severe drops in office rents are forecast – for example up to 40% in Berlin.

[…]

This is the point, where the initial article fades out with a handful of random ideas and formulations. However, the key point is made, and it very much holds today. Office attendance by both workers and companies will largely remain a matter of choice. While the latter analysis from Capital Economics seems way exaggerated from today’s point of view, there is, in general, a high degree of necessity to consider actions to secure tenants and minimise the risk of office building obsolescence.

Location, Asset Quality and Services are key to future proof your office

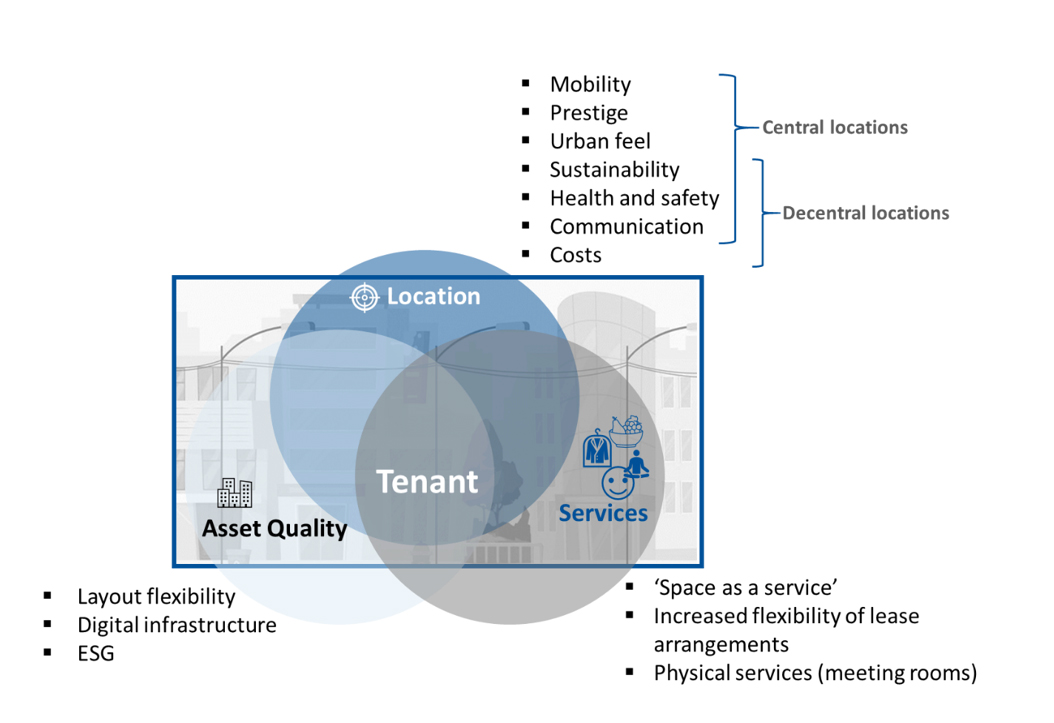

Exhibit 1: Key variables for future proof offices

We believe that there are three main pillars that will secure tenancy in offices over the long run: The quality of the location, the quality of the asset itself and accompanying services. Without commenting on every detail of Exhibit 1, we conclude that central, urban and dense office locations are in a particularly good position to satisfy modern and future office users’ needs. We also believe that a good location remains the decisive factor for successful office investments.

The asset quality plays an important role on various levels. Firstly, a strong ESG concept is a given and a necessity. The same applies to top-notch digital infrastructure, including redundant cable connections, WiFi throughout the building etc5. And lastly, but probably most importantly, flexible office structures, which can adapt the space utilisation as space requirements change over time, are key to future proof an office.

Services have increasingly become important and go far beyond the classic laundry service. Services become very powerful USPs when they are thought of on a large-scale and go into the building structure itself. This begins with curated communal areas; continues over ‘rentable’ large-scale conference rooms6; and ends with integrated serviced apartments that allow supra-nationally operating companies to efficiently execute global workshops and projects.

While many of the aspects above can be found in newly built properties, the majority of the existing stock is lacking this potential. So, there is both risk in the form of potential building obsolescence but also opportunity: ‘Manage to core’ and ‘future proofing’ value add strategies, that turn existing buildings in good locations into modern and top-notch assets, should prove viable strategies to secure long-term tenancy and income, while creating value.

And now for something completely different: Have a happy holiday season

Thank you for reading our PropBlog and thank you for staying with us in 2021. We are looking forward to welcoming you back in 2022 to discuss the state of the future.

Myself, the research team and everybody at CORESTATE wishes you an inspiring, peaceful and relaxing holiday season.

1 Current comments are formatted in brackets and italics

2 Given that the dominant global companies all operate in a distinctly supra-national manner, in fact a large part of their operations is happening in the digital, borderless space, nationalist tendencies appear very out of time.

3 Think AR and VR set-ups

4 European Commercial Property Focus, Sep 14th 2020: Remote working poses significant downside to rents; Capital Economics

5 As is measured and certified by specialists like WiredScore

6 Not every company needs a 30-seater boardroom every day. In fact, the fewest do

DISCLAIMER

This document has been prepared for general information purposes only. It does not constitute an offer or invitation to sell or issue, or to purchase or subscribe any shares in funds, securities or financial instruments, or any other shareholdings in or distributed by CORESTATE Capital Holding S.A. or any other company of the CORESTATE Capital Group (hereafter collectively referred to as the “Company”). No part of this document nor the fact of its distribution be or form part of or be relied on in connection with any contract or investment decision relating thereto, nor does it constitute a recommendation regarding the securities or the shares in funds or other financial instruments of the Company or of another entity. Therefore, this cannot be deemed as financial services, investment advisory services, an offer for the acquisition of a financial instrument or general investment advice, legal or tax advice.

The data and information contained herein has been obtained from various sources is believed to be reliable and accurate. All data and information derive from sources which the Company believes to be reliable. Furthermore, the Company has used its best endeavors to ensure that the presented facts and opinions are adequate and correct. Forward-looking statements and statements are based on current estimates, expectations and forecasts of the Company regarding market and industry developments at the time of preparation.

Nevertheless, no reliance may be placed for any purposes on the information contained in this document or on its completeness, accuracy or fairness. Neither the Company nor any of its directors, officers or employees or any other person makes any warranty or gives any guarantee, neither express nor implied, as to the accuracy or completeness of the information contained in this document, and accepts no liability for loss or damage of any kind in connection with this document, unless caused by gross negligence or intent of the Company and unless standing in a causal connection to the potential damage. The information is subject to change at any time (even without notification to the recipients). This document is an advertisement and not a financial analysis or a prospectus. The information and opinions expressed in this document are provided as of the date of this document. Certain statements, beliefs and opinions in this document, are forward-looking, which reflect the Company’s or, as appropriate, the Company’s directors’ current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document. No statement in this presentation is intended to be nor may it be construed to be a profit forecast. By attending the presentation to which this document relates or by accepting a copy of this document you agree to be bound by the foregoing limitations and, in particular that you have read and agreed to comply with the contents of this notice.