As discussed in a recent blog post, there are still many unknowns related to the COVID-19 pandemic and its impact on the global economy and society. This also extends to higher education and – linked to it – to purpose-built student accommodation (PBSA). Beyond the crisis and its cyclical impact though, there are structural trends supporting the investment case in student housing.

It is not clear yet how universities across the globe will organise and offer courses for the coming term. French and German universities are preparing for blended teaching – a combination of online lectures and some face-to-face teaching. In addition to that, the start of the coming term has been postponed by one month to November 2020 in Germany. In the UK, the universities of Cambridge, Manchester and Nottingham Trent have all confirmed that they will be delivering blended teaching, at least for the first term, but other universities are still discussing other options, like for example creating ‘social bubbles’ for student housing and adapting the university campus to allow for as much social distancing as possible when campuses reopen1. With full fees being charged even if courses are taught online and a high level of uncertainty still regarding travel, many international students are considering delaying their studies. A recent study conducted by QS among prospective international students showed that 64% of respondents stated in May that their plans to study abroad had been affected by COVID-19. Of those who stated that their plans had been affected, 53% intend to delay or defer their studies until next year2. Even domestic entry students might consider delaying their university enrolment, being reluctant to start their student career with online interaction only. In a recent poll of 516 students who have applied to a UK university this year, 71% of applicants would support moving the start of their first year of university to a later time if it meant more face-to-face teaching3. However, the full extent of the impact on student numbers at universities this coming term will only transpire closer to application deadlines, as many students are still in a wait-and-see-mode.

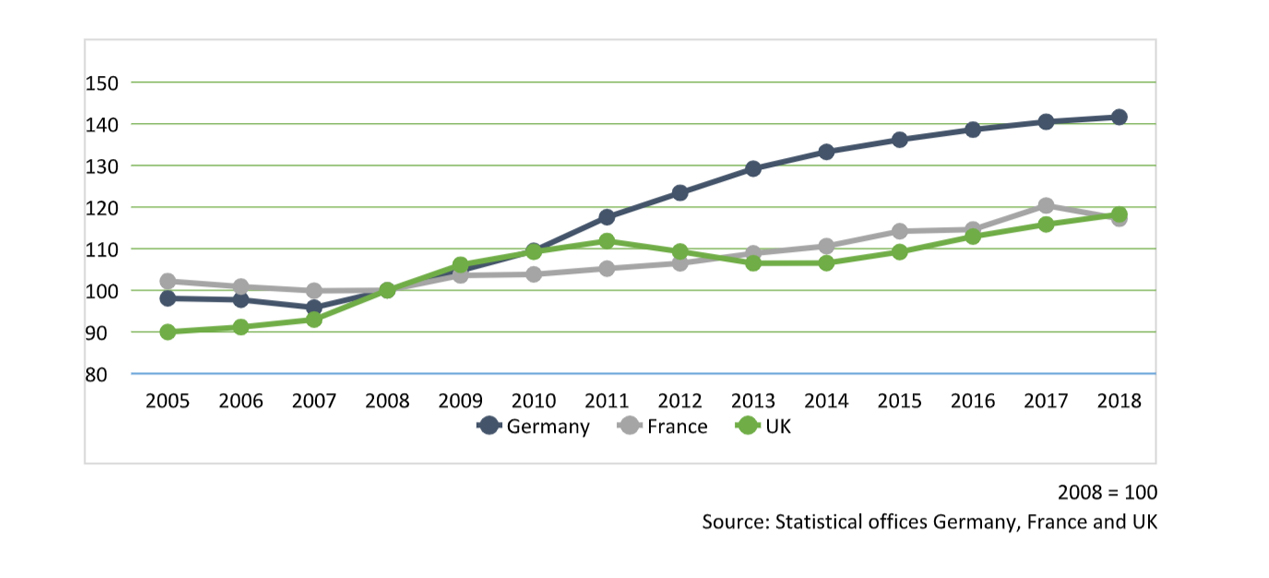

What we witnessed following the 2008/09 global financial crisis is that student numbers increased as university education is considered more important after a crisis and that the labour market for less-qualified school leavers was minimal. It is likely that the current crisis will have a similar effect on student numbers. Graduates who are not able to find a job in the current difficult job market, are likely to choose to add a further specialisation or skill to their resume and enrol for a post-graduate course in order to compete in a globalised and competitive job market.

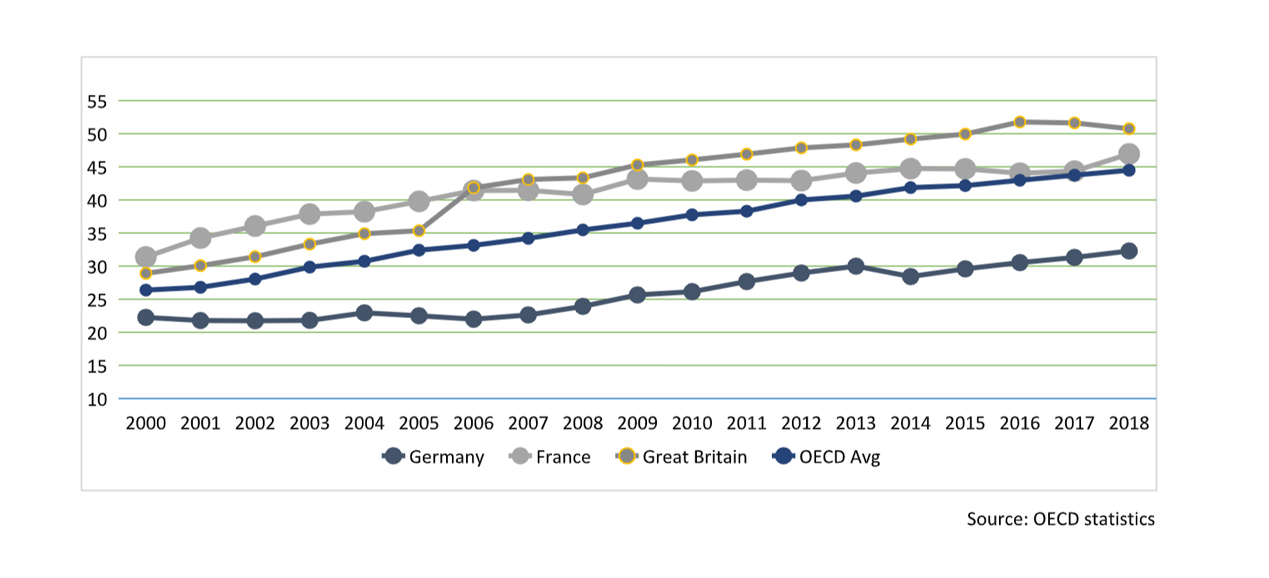

The underlying structural drivers for higher education in the long run remain multi-layered and very supportive. As emerging market economies have evolved, there has been a strong growth in higher education demand (for example from India, China, Indonesia and Nigeria) before the COVID crisis. Student numbers have been rising for many years and the percentage of university educated people has increased steadily. As university capacities take time to build, there has been a supply constraint in the higher education market from a global perspective. Secondly, for some years now, experts have identified general trends and changes in the labour market, such as a further development towards automation and digitisation, which make tertiary education increasingly important for success in the workplace.5 Lastly, students feel the need to get the best education possible to be able to compete in a globalised and competitive job market. With an increasing number of English taught programmes across Europe, they have an increasing choice in terms of destination, cost and method of study. In addition to that, many students believe the international experience gained when studying abroad will have a positive impact on range of skills and attributes and thus give them an edge when looking for a job after graduating.

1 The Guardian article: “UK universities plan to create ‘social bubbles’ when campuses reopen” | 2 QS Coronavirus Student Survey | 3 Impact of the Covid-19 pandemic on university deferral rates and student switching – May 2020 | 4 The spike in 2011 and subsequent reduction in the UK’s enrolments was due to the increase in university fees. | 5 PWC – „Will robots really steal our jobs?”

DISCLAIMER

This document has been prepared for general information purposes only. It does not constitute an offer or invitation to sell or issue, or to purchase or subscribe any shares in funds, securities or financial instruments, or any other shareholdings in or distributed by CORESTATE Capital Holding S.A. or any other company of the CORESTATE Capital Group (hereafter collectively referred to as the “Company”). No part of this document nor the fact of its distribution be or form part of or be relied on in connection with any contract or investment decision relating thereto, nor does it constitute a recommendation regarding the securities or the shares in funds or other financial instruments of the Company or of another entity. Therefore, this cannot be deemed as financial services, investment advisory services, an offer for the acquisition of a financial instrument or general investment advice, legal or tax advice.

The data and information contained herein has been obtained from various sources is believed to be reliable and accurate. All data and information derive from sources which the Company believes to be reliable. Furthermore, the Company has used its best endeavors to ensure that the presented facts and opinions are adequate and correct. Forward-looking statements and statements are based on current estimates, expectations and forecasts of the Company regarding market and industry developments at the time of preparation.

Nevertheless, no reliance may be placed for any purposes on the information contained in this document or on its completeness, accuracy or fairness. Neither the Company nor any of its directors, officers or employees or any other person makes any warranty or gives any guarantee, neither express nor implied, as to the accuracy or completeness of the information contained in this document, and accepts no liability for loss or damage of any kind in connection with this document, unless caused by gross negligence or intent of the Company and unless standing in a causal connection to the potential damage. The information is subject to change at any time (even without notification to the recipients). This document is an advertisement and not a financial analysis or a prospectus. The information and opinions expressed in this document are provided as of the date of this document. Certain statements, beliefs and opinions in this document, are forward-looking, which reflect the Company’s or, as appropriate, the Company’s directors’ current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document. No statement in this presentation is intended to be nor may it be construed to be a profit forecast. By attending the presentation to which this document relates or by accepting a copy of this document you agree to be bound by the foregoing limitations and, in particular that you have read and agreed to comply with the contents of this notice.

This presentation has been compiled by Corestate Capital Investors (Europe) GmbH, a company of the CORESTATE Capital Group, 19.05.2020.