The morning I learned about the appalling invasion of Ukraine was the beginning of the second day of our annual management strategy get together. Devastated, though not surprised, I realised the grave impact that the conflict has – on the geopolitical landscape, destroying 30+ years of efforts to sustain peace in the EU, as well as wider market developments including real estate. While initially markets expected the direct economic impact to be manageable, it is now increasingly evident that consequences of the unjust war that Putin brought over Ukraine are vast and have the potential to change everything.

Typically, investors need a trigger to reconsider investment strategies. Given the challenging environment of relatively low growth coupled with rising inflation, rates and financing costs, which we had already been in before the conflict, the war in the Ukraine could very well be such a trigger. While talking strategy and economics feels totally out of place and irrelevant in this context – against the backdrop of the humanitarian disaster, this post I will summarise the various macro-impacts of the conflict and the potential impact on real estate.

Clearly, the war’s impact on the Ukraine, as well as Russia, is devastating fraught with suffering and grief. Our thoughts are with the Ukrainian and the Russian people, still hoping for a quick end to the conflict.

Economics

The direct impact of the war and the imposed sanctions on Europe are indeed manageable as European exports to Russia merely account for 0.7% of GDP (0.6% for Germany). While there are individual businesses with closer links to Russia and the Ukraine, the overall business exposure, including banks, is not a big concern. So, a direct impact stemming from reduced trade is negligible1.

However, in terms of imports, Europe is hugely dependent on Russian oil and gas. According to an analysis from Bruegel2, 38% of the natural gas used in the EZ27 is coming out of Russia and the article concludes that it will be a momentous and costly task to relinquish Russian gas3. Already, the dependance on Russian commodities is obvious given the sharp rise in fuel prices within just a handful of days. Likewise, a crucial element of Russian and Ukrainian exports is the global supply of wheat. About a third of the globally exported wheat supply is produced in Russia and the Ukraine and particularly emerging countries in Africa, the Middle East and Asia depend on it4. Already, global wheat supply is struggling as shipping into and from the Black Sea ports has largely collapsed. If the upcoming spring planting season was to be disturbed, which is likely, particularly in Ukraine, a longer lasting food crisis seems inevitable. This will lead to steeply rising food prices and can cause massive issues in poor but dependent countries, threatening social and political stability.

In an early analysis, Capital Economics expected inflation to increase by another 1%pts to 2%pts this year5. In 20226, shortages in oil, gas and wheat will most likely cause even higher inflation globally and particularly in the euro zone, as direct energy dependance on Russia is high. Given the rapid rise in fuel prices, even double digit inflation rates seem possible. This will cause an indirect hit on the economy as it will reduce household disposable income and increase production costs. For households, there will likely be negative effects on discretionary spending causing shopping, travel, leisure and other expenditure to decline. For businesses, particularly those industries are hit, that have a large energy consumption. This includes the production of steel, for example, which is likely to have another upwards effect on construction costs. As prices rise and uncertainty is high, it is also likely that businesses will be cautious concerning capital expenditure and investment into equipment.

All this will lead to reduced economic growth and, in fact, the risk of a stagflation is increasingly discussed in the media, representing a no growth, high inflation scenario7. Most economic forecasters remain a bit on the upside but have reduced economic growth expectations as well.

Interest Rates and Capital Allocation

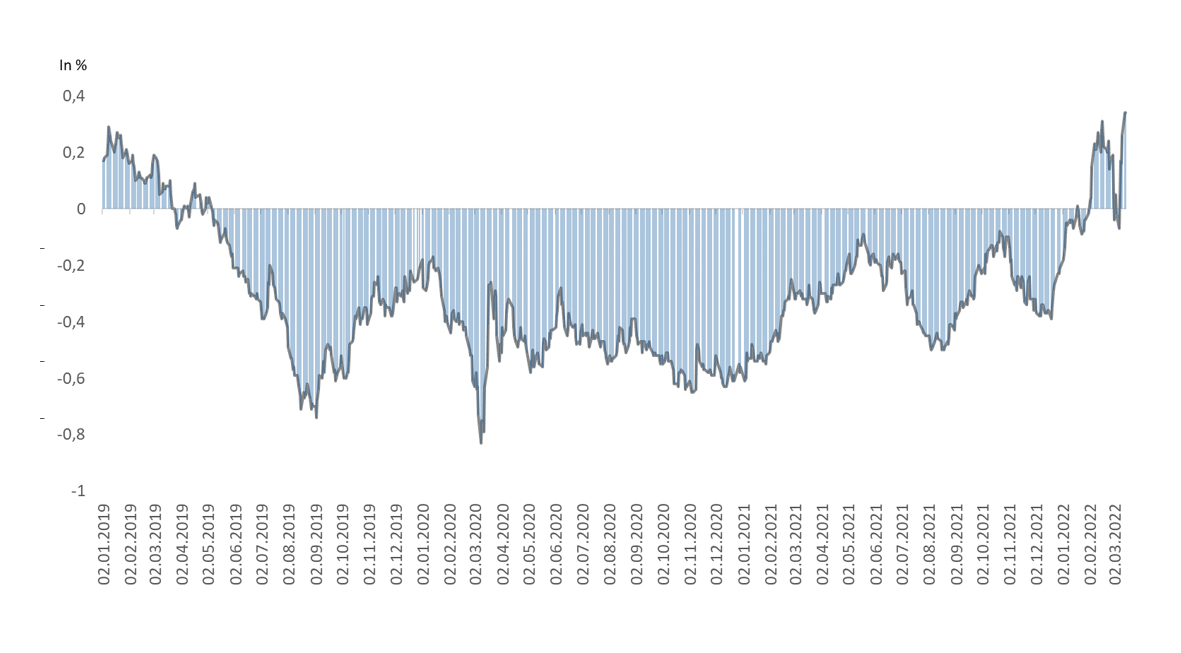

The war, the sanctions and the wider economic and socio-political consequences spur uncertainty and volatility. Markets and investors react by allocating money into assets perceived as safe havens including gold and government bonds. As a result, the yield on German 10-year government bonds has plummeted into negative territory in early March again, after it hit a three-year high of 0.3% in mid-February.

Central banks are now generally in a tough situation. They are confronted with rapidly rising inflation coupled with a highly uncertain environment and a lower growth outlook. While the Fed has decided to fight inflation more rigorously, the ECB has a more difficult task: A) because sanctions and energy dependance are more direct than in the US; B) because the ECB has to define one policy for a range of different countries, which have vastly different economic and, most of all, public debt profiles. The later aspect is well known and often discussed but it will remain a key factor for the ECB’s rate decisions, even as inflation rates surge.

However, on March 10th, the ECB surprised with a more-hawkish-than-expected narrative, concluding that reducing inflation is its primary target and that the war in the Ukraine does not require a change in monetary policy. Capital Economics expects a first rate hike of 25 bps in December with two further hikes in 2023. Clearly, this very much depends on the further development of the Ukraine conflict and its impact on the euro-zone’s economy and inflation.

Despite the low interest rates, the cost of finance for real estate has gone up markedly than the interest base, the 10 year Swap has gone up to more than 1%, from 0,1% in early December.

Impact on Real Estate Markets

The direct impact stemming from capital flows out of Russia or the Ukraine is very low, as initial analyses from RCA or PMA show. According to RCA, merely USD 330 mn per annum was invested out of Russia directly into the global real estate markets – so the impact if this capital source abated would be minimal8.

The more relevant impact is going to be indirect. Stemming from above described economic headwinds in combination with high inflation. As discussed earlier, this will likely become most relevant in sectors which depend on disposable incomes such as retail, restaurants and bars.

Expect a pause in the market, potentially a shift in allocation strategies

In addition to the more factual impact, the most crucial factor for real estate markets here will be investor sentiment. Typically, investments strategies are only adjusted very slowly, even when market conditions change (slowly). Unless there is a trigger, which causes investors to sit back and reconsider investment strategies.

This is a situation we are in now: The overall market conditions had already been challenging for real estate before the Ukraine conflict. Throughout 2021, inflation moved upwards to a level of about 5% in the euro zone and even more so in the US. As a result, central banks had become more hawkish and long-term rates rose. In early February, before the Ukraine conflict escalated, 10 year Swaps, detrimental for real estate debt finance costs, breached 80 bps, the highest in 3 years and significantly more than the bandwidth of 2021, which hovered between -30 and 30 bps. This means that financing conditions for real estate had worsened, reducing the potential leverage effect.

In addition, real estate’s relative attractiveness over government bonds declined as the yield spread of prime German offices to the 10-year German BUND was the lowest in 8 years. At the same time, economic growth projections were reduced, building risks of lesser rental growth for commercial and residential assets.

In this environment of lower growth expectations coupled with higher financing costs and a declining spread of property and government bond yields, Putin ordered the invasion of Ukraine. This has not only intensified the economic and inflationary stress, but also caused investors to become cautious and risk averse.

Given the historically low yields and high pricing of property9 in most sectors and regions, we believe that there will be a pause in Europe’s real estate market. It is likely that there will be limited new10 transaction activity over the next one or two quarters. In fact, risks are building that investors will adjust investment strategies, increasing exposure to – now higher yielding – government bonds and reduce real estate allocations.

It is also likely that international investors from America or Asia will be cautious concerning investments in Europe. One could, in fact, expect to see more investment exits from internationals reducing their European exposure while remaining profitable11.

While liquidity will certainly remain high, the overall market environment suggests that there will be reduced growth, declining investment demand and potentially increasing investible product. In combination with rising interest rates and financing costs, it is possible, that prices for European property might fall.

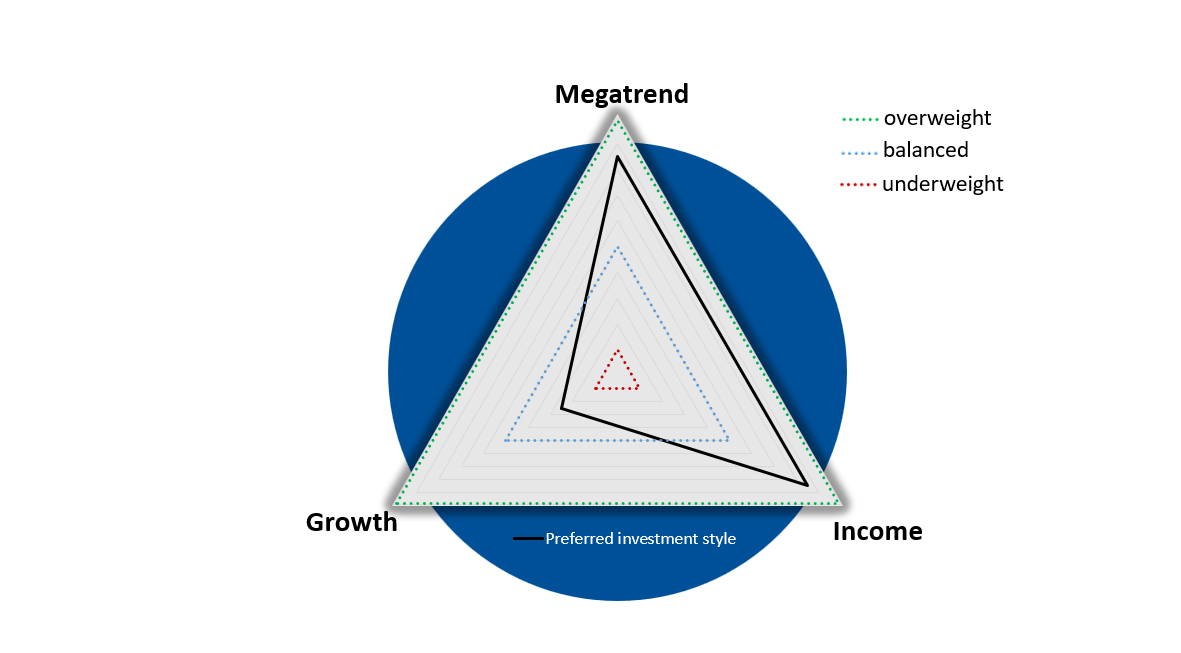

Overweight Income and Megatrend Driven Investments – be selective

While fundamentally the commercial and residential property markets, particularly in Germany, remain sound, the economic and geo political environment has many ingredients that could cause markets to turn. In this environment, we advise investors to be cautious and highly selective.

Growth12 is hard to find in this environment; therefore investment strategies with security of income focus, ideally hedged against inflation, as well as very long-term, megatrend based investments, like future proof offices, life science, data centers or senior accommodation, seem preferable.

We believe that a selective and tailormade approach is key in this environment. While this perception has not changed dramatically from what we discussed at the strategy days mentioned at the beginning of this post, the Ukrainian war and the disruption it causes has reinforced our view.

1 See, for example, Capital Economics: six-questions-on-ukraine-and-the-euro-zone.pdf (capitaleconomics.com)

2 Can Europe survive painlessly without Russian gas? | Bruegel

3 At the time of writing this piece, gas was still delivered from Russia to the EU

4 Food crisis looms as Ukrainian wheat shipments grind to halt | Financial Times (ft.com)

5 six-questions-on-ukraine-and-the-euro-zone.pdf (capitaleconomics.com)

6 And potentially 2023, dependent on the further development of the conflict. If there was an early solution, oil and gas prices could revert, causing a dis-inflationary momentum next year

7 See for example: Stagflation, like worst of pandemic, is avoidable | Reuters; Europe markets: U.S., Europe mull Russian oil ban; oil prices surge (cnbc.com); Ukraine Confronts Investors With Risks of Stagflation and Nuclear Armageddon – Bloomberg

8 RCA Commercial Real Estate Sales Trends & Market Research (rcanalytics.com)

9 In fact pricing is high in historic terms for most asset classes

10 Transactions that already are in an advanced stage will still be concluded over the next couple of months

11 An example would be Vestas seeking an exit for a 1bn two buildings portfolio. See Korean investor considers €1bn European office portfolio sale – React News

12 Rental growth or capital growth

DISCLAIMER

This document has been prepared for general information purposes only. It does not constitute an offer or invitation to sell or issue, or to purchase or subscribe any shares in funds, securities or financial instruments, or any other shareholdings in or distributed by CORESTATE Capital Holding S.A. or any other company of the CORESTATE Capital Group (hereafter collectively referred to as the “Company”). No part of this document nor the fact of its distribution be or form part of or be relied on in connection with any contract or investment decision relating thereto, nor does it constitute a recommendation regarding the securities or the shares in funds or other financial instruments of the Company or of another entity. Therefore, this cannot be deemed as financial services, investment advisory services, an offer for the acquisition of a financial instrument or general investment advice, legal or tax advice.

The data and information contained herein has been obtained from various sources is believed to be reliable and accurate. All data and information derive from sources which the Company believes to be reliable. Furthermore, the Company has used its best endeavors to ensure that the presented facts and opinions are adequate and correct. Forward-looking statements and statements are based on current estimates, expectations and forecasts of the Company regarding market and industry developments at the time of preparation.

Nevertheless, no reliance may be placed for any purposes on the information contained in this document or on its completeness, accuracy or fairness. Neither the Company nor any of its directors, officers or employees or any other person makes any warranty or gives any guarantee, neither express nor implied, as to the accuracy or completeness of the information contained in this document, and accepts no liability for loss or damage of any kind in connection with this document, unless caused by gross negligence or intent of the Company and unless standing in a causal connection to the potential damage. The information is subject to change at any time (even without notification to the recipients). This document is an advertisement and not a financial analysis or a prospectus. The information and opinions expressed in this document are provided as of the date of this document. Certain statements, beliefs and opinions in this document, are forward-looking, which reflect the Company’s or, as appropriate, the Company’s directors’ current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document. No statement in this presentation is intended to be nor may it be construed to be a profit forecast. By attending the presentation to which this document relates or by accepting a copy of this document you agree to be bound by the foregoing limitations and, in particular that you have read and agreed to comply with the contents of this notice.